Our commitment to fundraising will be remunerated as a percentage of the funds raised and according to certain clauses which will not be a cost for the start-up.

Home » Joint-Venture

A Joint Venture is a mutually beneficial agreement between two or more companies that have complementary resources.

That is, services, products, businesses, assets, and a customer list that has a relationship with the owner of the list that can be leveraged to minimize costs.

Our experience could be summed up in 4 points:

So, we are ready to balance our risk with you based on the type of business and the importance of the shared resources.

We believe that certain objectives can be achieved only if the method is good enough.

The optimal method is obtained when the collaboration between customer and supplier is very close: for example between the partners of the company.

A joint venture is the best replication of the situation between partners with the only difference that it is limited until the conclusion of the joint venture contract.

With this modality we want to offer the following services

Spinoff and Business Unit are two start-up methods. So similar but the Business Unit is a start-up within the parent company therefore its losses and profits affect the company balance sheet.

In the spin-off, on the other hand, some corporate assets pass to the outside and therefore the destinies of the two companies do not influence each other much.

Investments are also different because new shareholders could enter the spin-off with very different power relationships than those present in the parent company.

Spin off

Most likely the business has started at least in part, and most likely the new company inherits important assets that facilitate its take-off and break-even can be achieved with lower risks.

This offers greater advantages and therefore fewer risks, compared to a start-up that starts from scratch.

Business Units

The link with the company is very close and also the influence of the parent company remains strong and decisive. The innovative capacity of a business unit is, in general, less strong and power remains highly concentrated within the organization of the parent company.

There is no external capital and the fate of the business unit influences and is influenced by the commercial and financial fate of the parent company.

It could be a preliminary stage to the spin-off or it could be reabsorbed by the parent company after a run-in and experimentation phase.

In the case of the spin-off, Fundraising campaigns could be applied and necessary which, on the other hand, do not make much sense in the case of the establishment of a Business Unit.

When a new business opportunity is glimpsed it is necessary that the corporate procedures applicable in the new business unit do not hinder the initiative which must be very flexible without the constraints of standard procedures (i.e ISO 900x) and without creating organizational disruption with other departments of the company.

The start of a new initiative is typically chaotic regardless of the form but focusing on the substance of the business.

For all these reasons, the creation of a new business unit becomes the viable solution and if it works then we can think of a real spinoff.

Even in a Business Unit it is possible to imagine a Joint Venture contract which is limited in terms of time and objectives and which could be the seed for the creation of a new start-up born from a spin-off of the Business Unit

The team that will form the business unit will have to be selected very carefully from among the resources of the company who have expressed a desire for new experiments. In short, subjects who could become maladapted or too innovative with respect to the cultural standard of the parent company.

Other resources of managerial rank (« C » Level, i.e) could be identified in companies that have a certain affinity to the new business and which in fact could be competitors by obtaining two important results: acquire know-how, remove know-how from the competition . This process is called “head hunting” and is strategic in creating a business unit.

The first step is the presentation of the business idea.

Preliminary analyzes and studies are needed which will give rise to a commercial/emotional synthesis called “elevator pitch”, which will have to breach decision-making power.

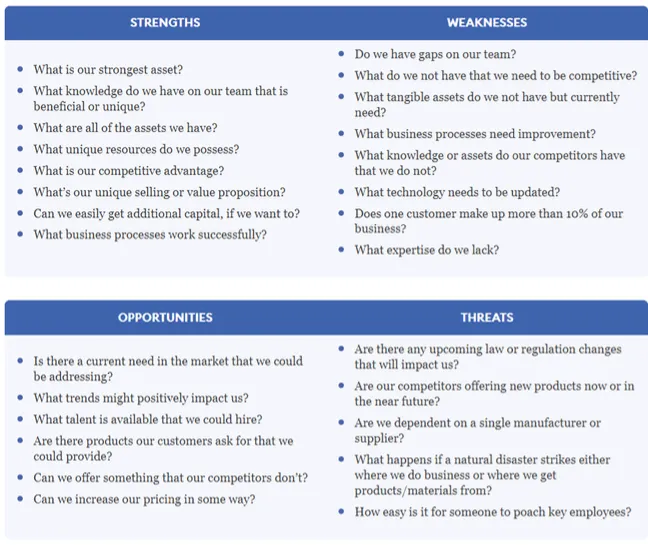

Conduct a SWOT Analysis

SWOT stands for strengths, weaknesses, opportunities and threats. Conducting a SWOT analysis allows you to look at the facts about how your product or idea might perform if taken to market, and it can also help you make decisions about the direction of your idea. Your business idea might have some weaknesses that you hadn’t considered or there may be some opportunities to improve on a competitor’s product.

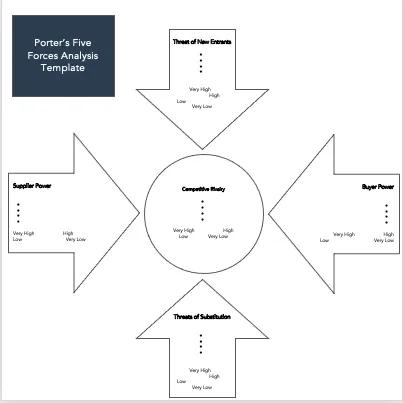

Porters Analysis

Source: yourfreetemplates.com

Then you will have to submit the business plan to the decision-making power, which is a much more detailed plan on marketing, organizational and financial aspects. So in reality there are 3 separate documents:

The primary attention of a business unit is to immediately identify its target market and try to sell something similar to the product that will become the core business of the spinoff following the establishment of the start-up business unit.

This is because the definitive business model has yet to be developed and has yet to be tested in the field. Might as well start immediately because from the market you will have the definitive confirmation of the goodness of the initial business idea suitably modified by market expectations.

Obviously, product manufacturing, configuration, pricing and service support will depend on the business model adopted.

This operation must travel in parallel with the technological innovation of the product and carried out by a team that has a commercial and marketing value and is immediately ready for customer care.

Therefore, the first operational nucleus will be composed of these skills of both ‘C’ level and Intern. By ‘Intern’ we mean young people on their first job – therefore just out of university with excellent grades and with a degree thesis that has a certain proximity to the new product and the new business model on which this game is being played.

This operational team with marketing value had to identify and analyze successful and unsuccessful cases in order to learn from the experiments of others, reducing new experiments with the risks associated with wrong choices discovered too late.

Certainly, the identification of all the characteristics of the buyer persona will be fundamental.

Conducting in-depth market research on your field and the demographic of your potential clientele is an important part of crafting a business plan. This involves running surveys, holding focus groups, and researching SEO and public data.

Second Critical success factor: Prototyping

The prototyping of the product will be equally fundamental.

That is, which technological solution is the backbone of the new product?

On which channels to sell it?

online, offline, marketplace, social, cold call, friends, in an event boot?

The sales channel is the most critical point. Surely the website is essential. A few pages, even if done in a hurry, are enough. Don’t give in to the temptation to start on a market place or cold call or on a social network, such as facebook or amazon.

After building the website, then try the different channels that will help you get to know the buyer persona better. But the first customer will buy only after he takes a tour of your website.

Start now for free, freemium?

It is necessary to make the first sale as soon as possible to get to know the new customer closely and find out how much he differs from the assumed buyer persona.

Then adjust the shot to find the second customer even when the product is not yet ready and even when the customer’s price has not yet been defined.

It is said that if it is sold at the “zero” price, then the product can also be sold at a price greater than zero. Then start giving it away.

This technique was used by Mr. Seth Godin with the success of the book which was offered free for a few months and then went on sale becoming a global best seller.

However this may not always be true. It can’t be true for every type of product. Great creativity is also needed in this area!

1.

You select your filing options and services

You choose the filing option and add-on services that fit your needs like registered agent, employer ID number (EIN), worry-free compliance, or faster filing speeds.

2.

We file your formation documents with the state.

Our team collects and files all the necessary paperwork with the state to officially form your business based on the services and time-frame you select at checkout.

3.

The State processes and confirms your business.

This process can take a few days or a few weeks depending on the filing speed you select and the state’s internal processes and formation backlog.

4.

We deliver all documents to your dashboard

The documents include your business formation certificate and employer identification number (EIN), assuming you purchased those services.

5.

We provide services to grow your business.

We provide ongoing compliance services to keep you in good standing along with website, accounting, and invoicing services to help run and grow your business with ease.

Strategic surveys

mckinsey.com

Elevator Pitch

offers.hubspot.com

Porters: Five force analysis

yourfreetemplates.com

Business plan: start-up kit

blog.hubspot.com

offers.hubspot.com

When a company creates a new independent company by selling or distributing new shares of its existing business, this is called a spinoff. A spinoff is a type of divestiture. A company creates a spinoff expecting that it will worth more as an independent entity. A spinoff is also known as a spinout or starburst.

Why do we at AWS consider spin-offs and not start-ups in general?

Because the probability of a start-up taking off is very low without the intervention of an incubator and without large risk capital available.

But if the start-up has found an incubator and an investor, willing to finance, it has also found an expert organization with an organizational structure that knows how to get the start-up off the ground.

We can help a spin-off take off because it requires a reduced financial effort, and we feel we can guarantee a good chance of success.

A parent company will spin off part of its business if it expects that it will be lucrative to do so. The spinoff will have a separate management structure and a new name, but it will retain the same assets, intellectual property, and human

A corporation creates a spinoff by distributing 100% of its ownership interest in that business unit as a stock dividend to existing shareholders. It can also offer its existing shareholders a discount to exchange their shares in the parent company for shares of the spinoff. For example, an investor could exchange $100 of the parent’s stock for $110 of the spinoff’s stock. Spinoffs tend to increase returns for shareholders because the newly independent companies can better focus on their specific products or services.

Source: investopedia.com

A spinoff may occur for various reasons. A company may conduct a spinoff so it can focus its resources and better manage the division that has more long-term potential. Businesses wishing to streamline their operations often sell less productive or unrelated subsidiary businesses as spinoffs. For example, a company might spin off one of its mature business units that are experiencing little or no growth so it can focus on a product or service with higher growth prospects.

Alternatively, if a portion of the business is headed in a different direction and has different strategic priorities from the parent company, it may be spun off so it can unlock value as an independent operation.

A company may also separate a business unit into its own entity if it has been looking for a buyer to acquire it but failed to find one. For example, the offers to purchase the unit may be unattractive, and the parent company might realize that it can provide more value to its shareholders by spinning off that unit.

Source: investopedia.com

The downside of spinoffs is that their share price can be more volatile and can tend to underperform in weak markets and outperform in strong markets. Spinoffs can also experience high selling activity; shareholders of the parent may not want the shares of the spinoff they received because they may not fit their investment criteria. The share price may dip in the short term because of this selling activity, even if the spinoff’s long-term prospects are positive.

Spinoffs are a common occurrence; there are typically dozens each year in the United States.[1] Recent examples include the 2020 spin off of Smith & Wesson from American Outdoor Brands or the separation of PayPal from its parent company eBay.[2] [3]

Source: investopedia.com

The main reason for a spinoff is that the parent company expects that it will be lucrative to do so. Spinoffs often increase returns for shareholders, as the newly independent companies can prioritize specific products or services. A company may conduct a spinoff to focus its resources and better manage the division that has greater long-term potential, if a segment of the company is moving in a new direction and has different strategic priorities from the parent company, or if the parent has been searching for a buyer to acquire that division of its business but previously failed to find one.

Source: investopedia.com

A company can create a spinoff by distributing the entirety of its ownership interest in that business unit as a stock dividend to existing shareholders, in addition to offering its existing shareholders a discount to exchange their shares in the parent company for shares of the spinoff. The spinoff will receive its own name and a separate management structure, though it will retain its original assets, intellectual property, and human resources. The parent company will usually continue to provide financial and technological support.

Source: investopedia.com

The biggest downside of a spinoff is that its share price tend to be more volatile, in addition to typically underperforming in weak markets and outperforming in strong markets. Since shareholders of the parent may not want the shares of the spinoff they received in their portfolios, they can also experience high selling activity. As a result, the spinoff’s share price may dip in the short term, even if the company has good long-term prospects.

Source: investopedia.com

Before a spin-off, we believe it is necessary to have successfully completed the process of creating a business unit within the parent company.

During this process it was possible to identify the product, the business model, the necessary hard/soft infrastructure, the creation of a product, albeit a prototype, a website, a composite team that will be the first nucleus.

Having therefore convinced the management of the parent company (partly in the role of incubator – to finance at least in part – the first phase and to participate, at least in part – in the equity investment and in a not too marginal role of stakeholder.

In short, the leap to be taken is not totally in the dark and the help that the newborn company needs is rather limited, and the probability of success is quite high without having high risk capital and a low success rate.

Surely it will be necessary to find funding sources, remodel the organizational structure that remains scalable as the product takes on a more defined shape and with ever higher sales volumes.

So, the ideal partner is the one that temporarily covers the missing roles until the skills and infrastructure have been identified that can be able to grow independently and find all the necessary skills internally to facilitate the scalability of growth detaching himself more and more from the umbilical cord of the parent company from which the spin-off took place.

Our role must be able to undo the umbilical cord from the parent company from which the spin-off took place and to complete the ‘weaning’ up to the moment in which the new organization will be able to declare itself autonomous because it is able to walk with your own legs.

So operating in this mode the probability of success is higher and with lower investment levels in shorter times.

In short, everything could be more advantageous: both on the part of stakeholders, shareholders, employees and partners.

In these conditions we are able to assume our share of risk and responsibility and therefore to be considered stakeholders interested in the role of temporary manager, shareholder, service provider which at the moment is not convinced that they are internal but more convenient as an outsourcer.

These commitments will tend to decrease, and the value of our shares will re-evaluate, and its surplus value will reward us for the investment that we too – partially – have sustained.

What Is a Startup?

The term startup refers to a company in the first stages of operations. Sturt-up are founded by one or more entrepreneurs who want to develop a product or service for which they believe there is demand. These companies generally start with high costs and limited revenue, which is why they look for capital from a variety of sources such as venture capitalists.

We can give our services with some business model suited with sustainable way. It means the payments and the price is flexible to avoid financial strangulation, waiting for the right moment to collect the invoices which among other things are agreed on the basis of very flexible agreements

Our services are in the following areas:

Start-up accelerators

startupbootcamp.org

angelpad.com

fintechinnovationlab.com

startup.google.com

Incubators

zenbusiness.com

incauthority.com

incfile.com

northwestregisteredagent.com

Seth Godin Blog

seths.blog

en.wikipedia.org

Fundraising is the process of soliciting voluntary donations and funds from individuals or businesses to help your organization grow. However, fundraising goes beyond just collecting funds. It helps organizations spread awareness about their cause, build relationships, garner support, and attract potential new donors.

While most nonprofit fundraising campaigns are different from one another, there are common best practices you can use across all campaign types to set yourself up for success. Use the eight tips below to ensure your next fundraising effort runs smoothly, engages more supporters, and helps move your charitable organization forward.

Type of Fundraising campaigns

How to run a successful fundraising campaign

The best fundraising ideas

Donation matching drives

Source: classy.org

When starting a new business from scratch and even from a spin-off, any preliminary budget is bound to be exceeded.

This is because it is not easy to predict every detail and it always seems that a small unexpected expense can speed up time to market or can be a winner over the competition.

So the temptation to find funds is irresistible.

In our commercial policy in which we want to share objectives, expenses and advantages, we plan to work hard to find funds by avoiding banks and finance companies because the credibility of a start-up and the guarantees it can offer do not convince the banks and anyway the loaned money has interest rates that are too high.

Our commitment to fundraising will be remunerated as a percentage of the funds raised and according to certain clauses which will not be a cost for the start-up.

Age of Innovation

HR, Hybrid World

Education

Training on the Job

Training on the Job

© 2024 Altos Web Solutions. All Rights Reserved!